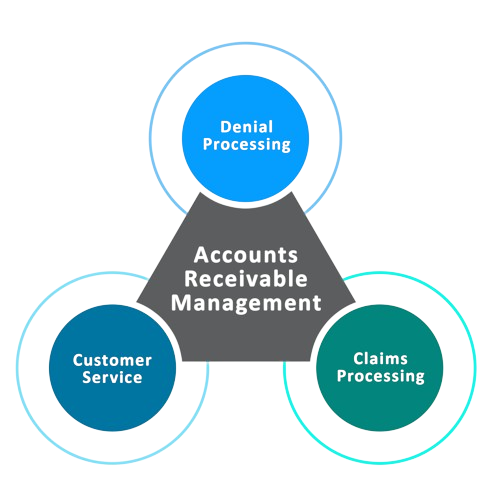

Accounts Receivable (AR) refers to the money a company is owed for goods or services that have been provided but not yet paid for. Effective AR management is essential for maintaining a healthy cash flow, ensuring timely payments, and minimizing bad debts. This process involves issuing invoices, defining payment terms, tracking outstanding payments, and following up on overdue balances.

In AR management, businesses monitor the aging of receivables to identify and prioritize collection efforts for overdue accounts. Tools like aging reports categorize invoices based on how long they’ve been outstanding. Companies also use the accounts receivable turnover ratio to measure how quickly they’re collecting payments, which reflects overall financial efficiency.

Efficient AR management reduces the risk of unpaid invoices, improves cash flow, and supports long-term financial stability. In industries like healthcare, where billing can involve multiple payers, managing accounts receivable is crucial for ensuring operational health and revenue growth.